The 2021 Online Business Investment Survey

What You Need to Know Before You Buy Anything

By Maggie Patterson

All opinions in this post are my opinions and mine alone.

Table of Contents

The Invest at All Costs Message

Buyers vs. Sellers: Who’s Winning?

Overview of Survey Participants

Do We Get Better Results by Spending More?

What the Best Business Investments Have in Common

What We Can Learn from the Worst Business Investments

Why Are We Still Being Manipulated?

Listen Now To This Essay On The BS-Free Service Business Show

As business owners, we all know that making sales is necessary to survive, otherwise, we don't have a business at all.

When it comes to how we make those sales, we’ve got an endless number of options. This is especially true in the online business world where, thanks to the magical powers of the internet, we’ve learned hundreds, or maybe even thousands of strategies and tactics to help close the sale.

One would think that having so many options to sell would be good for business, but the truth is much more complicated. In online business, much of the status quo of sales is built on using fear-based tactics to manipulate people into buying.

Buyers vs. Sellers: Who’s Winning?

After watching this play out for years, I’ve realized that these sales strategies and tactics serve only one person: the seller.

The odds are stacked in favor of the seller as they typically hold more power and influence, and in an industry with no accountability or professional standards, buyers can be left holding the bag.

This is why I got curious about what was really happening with people making these investments, and what prompted me to conduct this survey.

I wanted to get a bird’s eye view of what’s really happening when it comes to spending money on courses, programs, masterminds, memberships and coaching.

In January 2021, I conducted a survey over the course of one week asking a series of questions regarding business investments. 42 people participated providing in-depth answers on what they’ve experienced, sharing the good, the bad, and the ugly related to investments they’ve made into these types of offers.

A huge thank you to everyone who participated. Their candor and enthusiasm are what made this essay possible.

With the survey, my goal was to broaden my perspective and get a glimpse into what’s really happening across the online business market.

Here’s what I uncovered.

Overview of Survey Participants

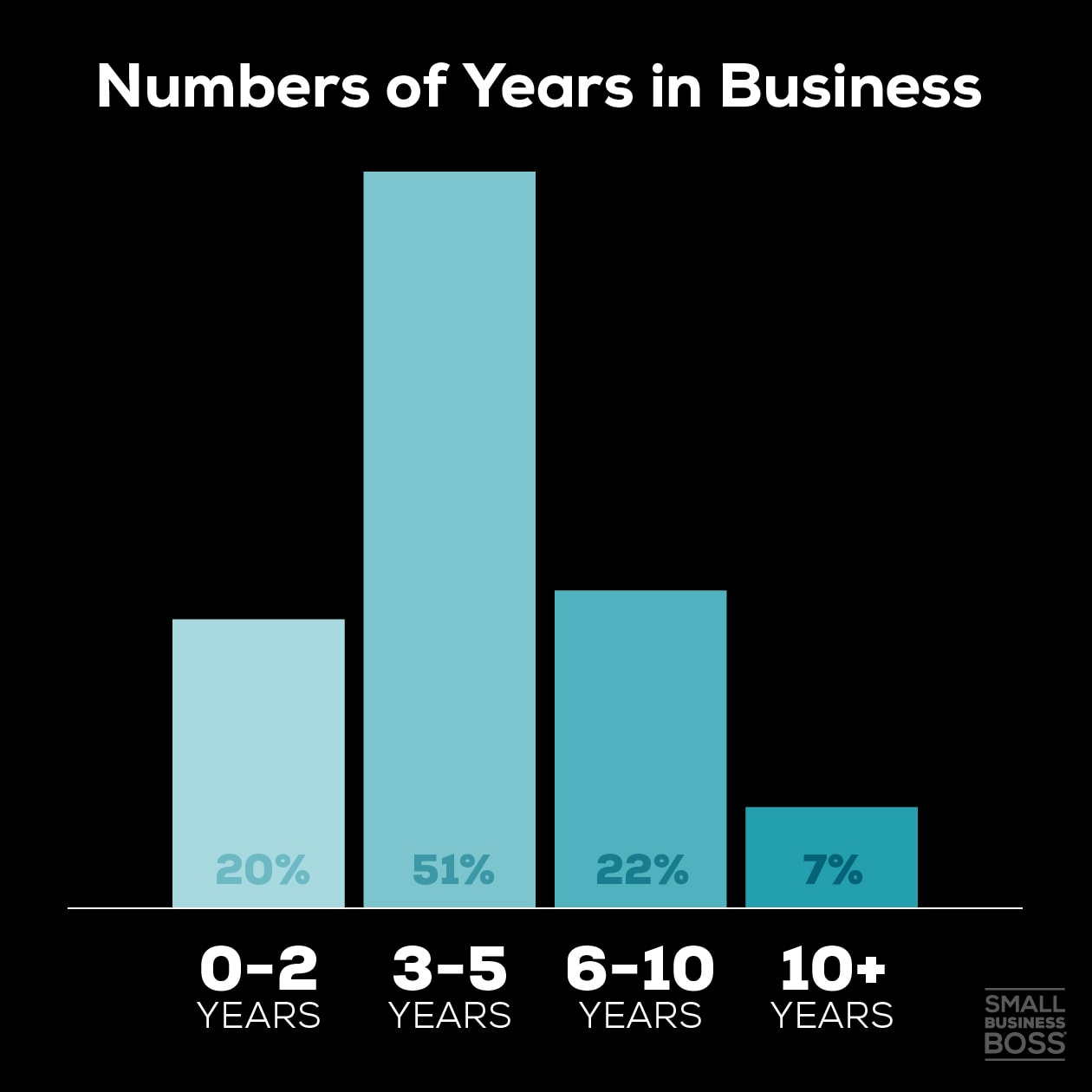

The 42 participants all own their own business with a range of business types, from courses to coaching to done-for-you services.

In terms of experience, they had anywhere from a few months to 22 years running their own business.

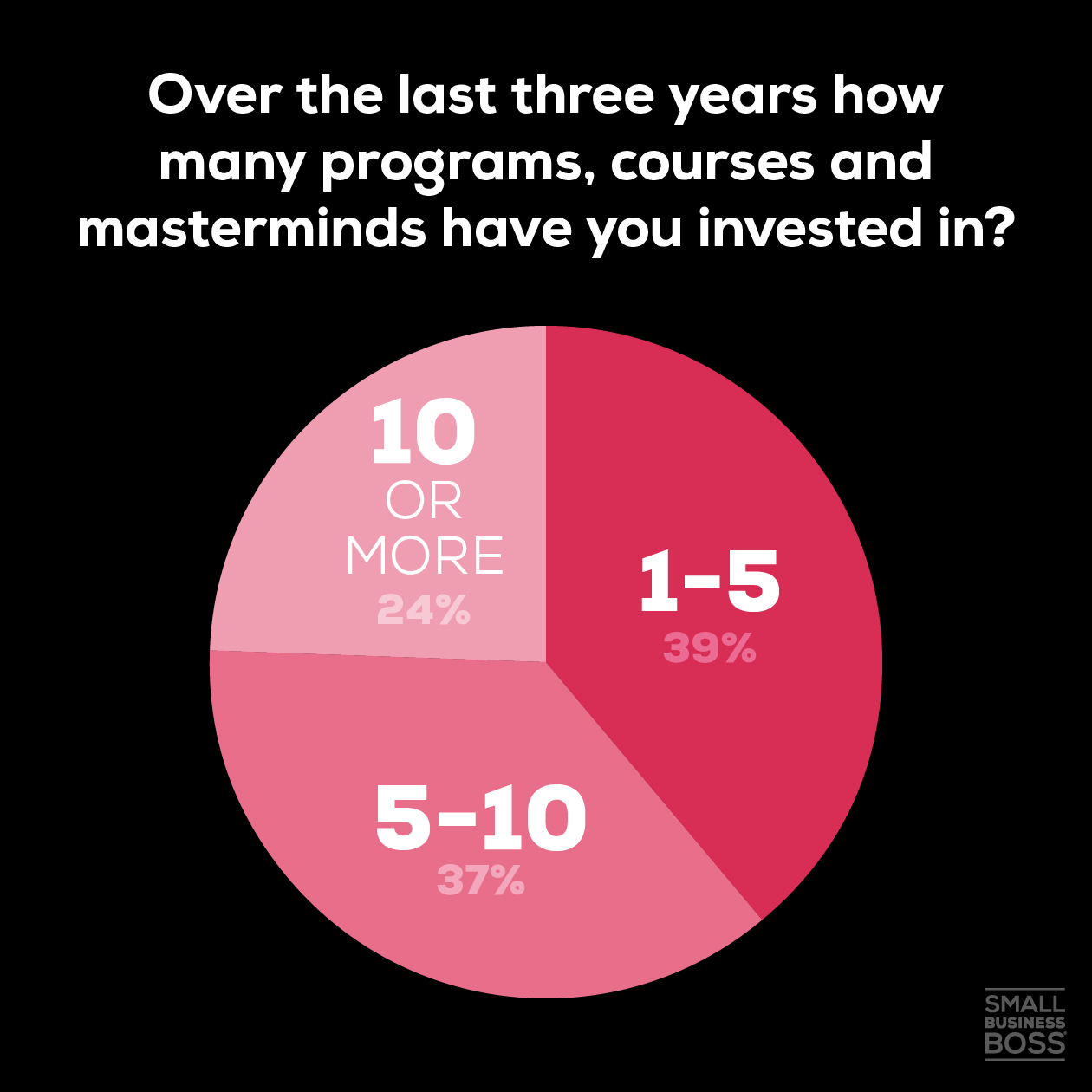

When asked how many investments, focused on courses, coaches, programs and masterminds (not done-for-you services) they’ve made over the last three years, 39% had invested in 1 to 5, 35.6% had invested in between 5 to 10, and 24.4% had invested in 10 or more.

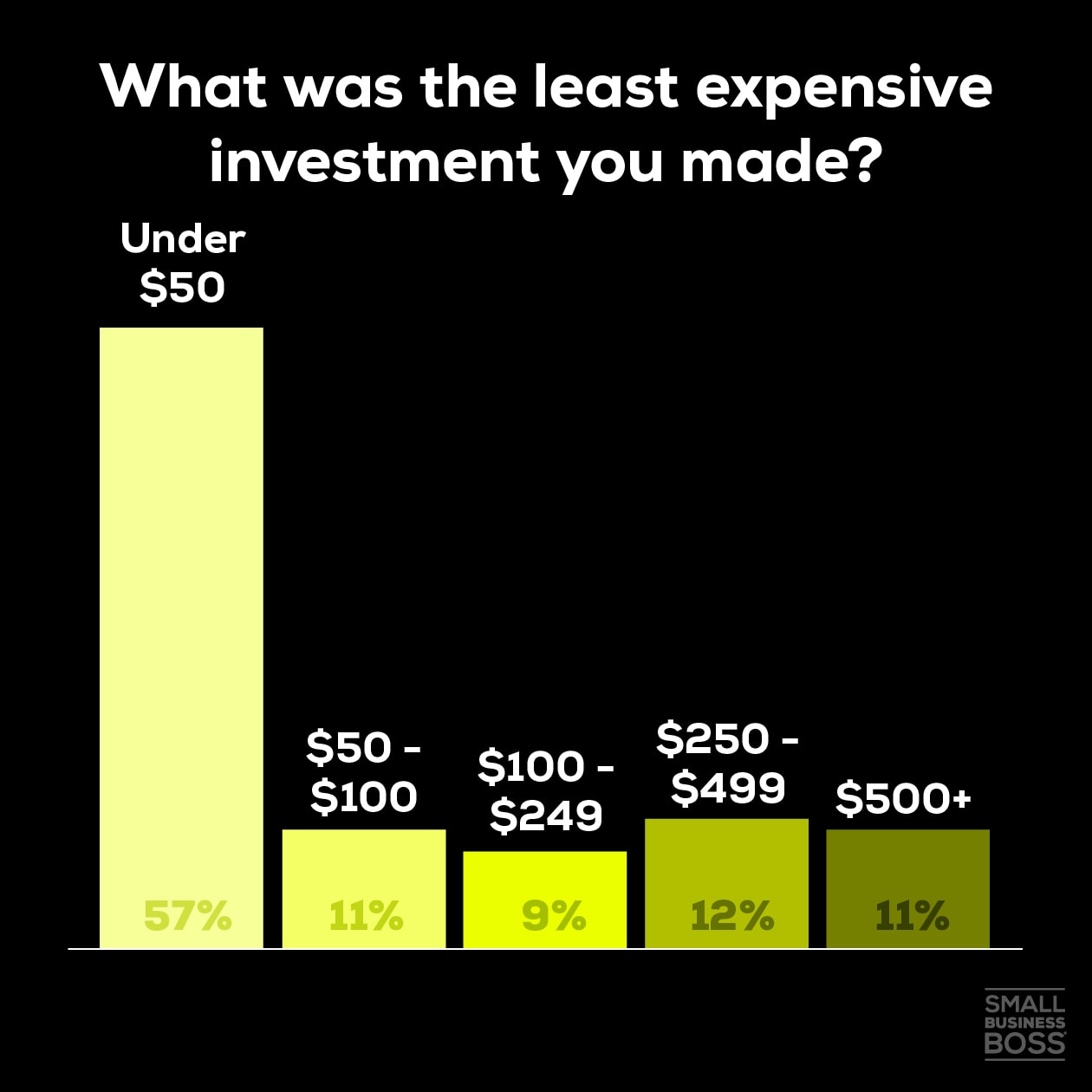

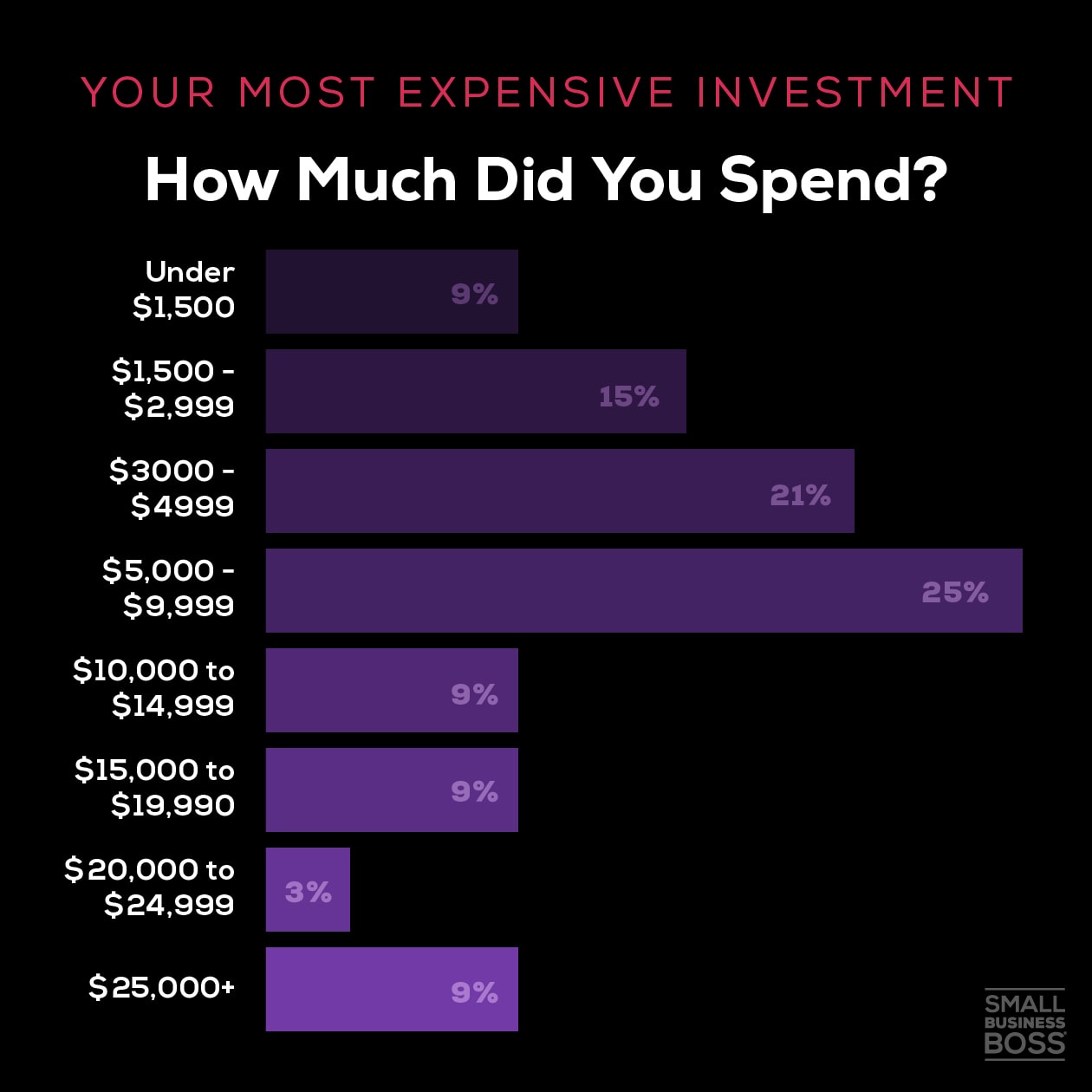

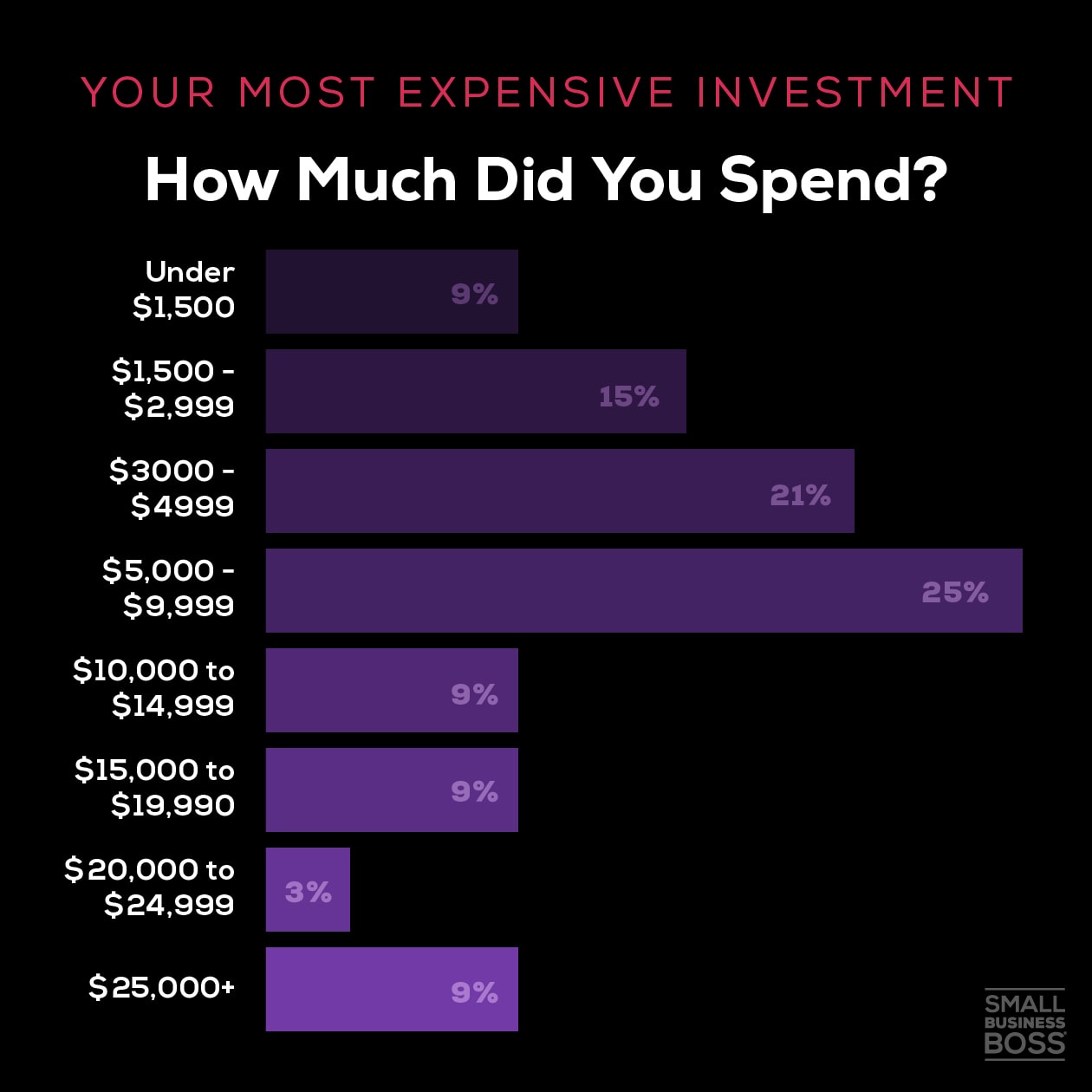

To get an idea of how much money had been spent on these offers, I asked about their most and least expensive investments. For the least expensive investments, it was anything from $27 to over $500.

I also asked about their most expensive investment, as there’s a distinct idea within the industry that if you spend more that you’ll get better results. I wanted to explore this further to determine if it was true or not.

Do We Get Better Results by Spending More

In our capitalist society, we’ve been taught to value things that cost more. We’re conditioned to think that “luxury” priced offers must be of superior quality, even when there’s no proof to back it up.

When it comes to investing in our business, we may choose to spend more on something as we believe we’ll have a better result.

Plus, there’s a certain amount of prestige that goes with these higher ticket offers. Studies have shown that for many of us, purchasing a luxury item boosts self-esteem and gives us a sense of belonging. In other cases, simply spending that money may give us a sense of accomplishment.

The question then is, do people get better results by spending more?

First, let’s look at why people made this purchase. There was a wide range of answers, but they broke down in a few key categories.

Wanting to Grow

A big motivator for many people was that they were looking for help growing their business. They wanted someone to provide specific guidance on their next steps. Feeling stuck in their business was a common theme.

Community and Peer Support

Owning a business can be lonely, and people invested in these offerings to connect with peers, grow their network and be part of a broader community.

Trust

When asked what prompted them to buy, trust was cited by many respondents as the reason they made the decision. This ranged from recommendations from people they trust, to being a long time follower of the person before deciding.

“I’d been following this person for a long time. I liked her ideas. The energy she showed up with and it was clear that she genuinely helped people.”

- Dr. Michelle Mazur, CEO, Communication Rebel

There were also a few people that shared they were 100% caught up in the hype when deciding to invest.

Now that we know why they bought, let’s look at what they bought and how much they spent.

The type of offer was split nearly evenly between group programs, courses, masterminds, and others, which includes coaching and memberships.

The size of the investments made ranged greatly from relatively lower ticket ones through to programs over well into the five figure range.

The size of the investments made ranged greatly from relatively lower ticket ones through to programs over well into the five figure range.

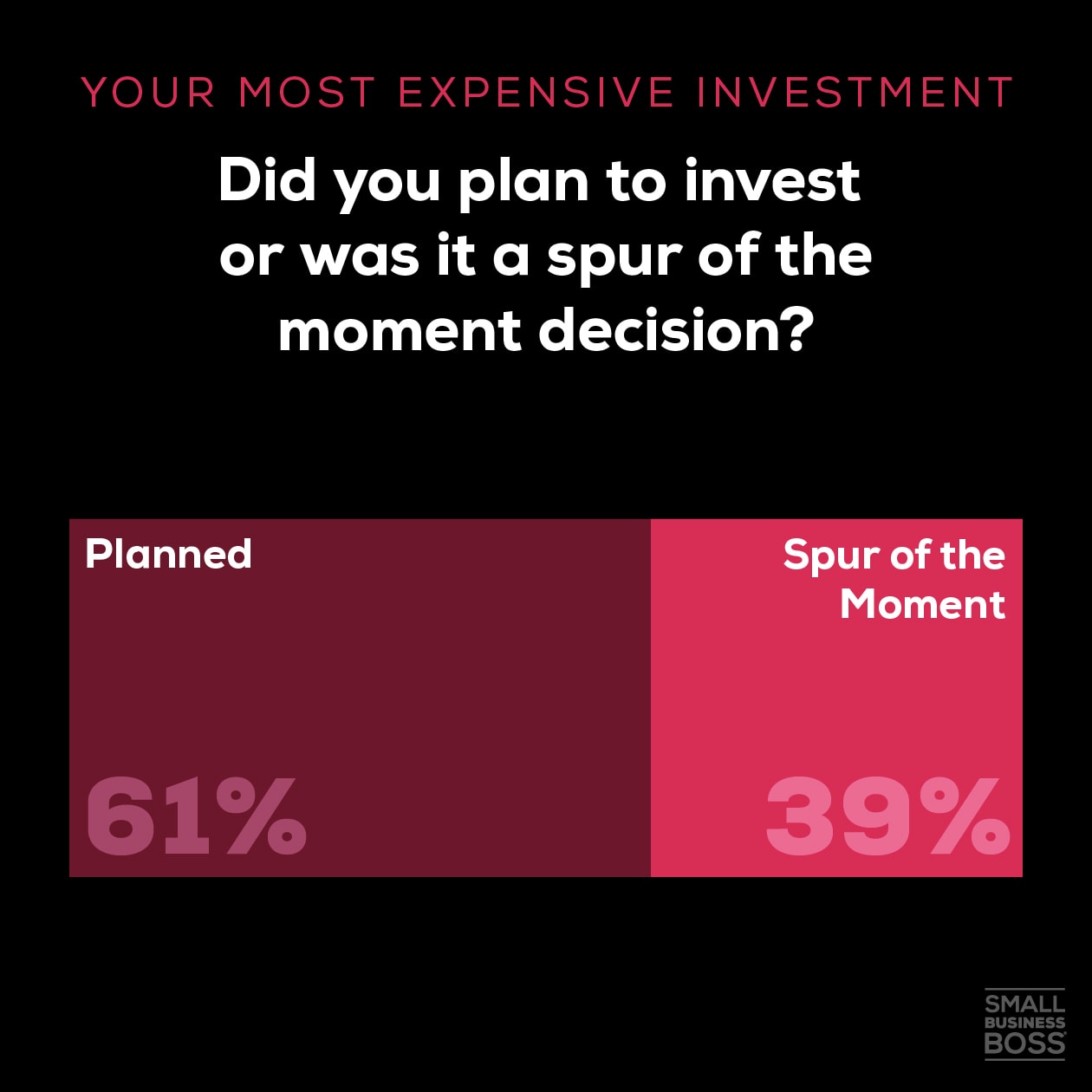

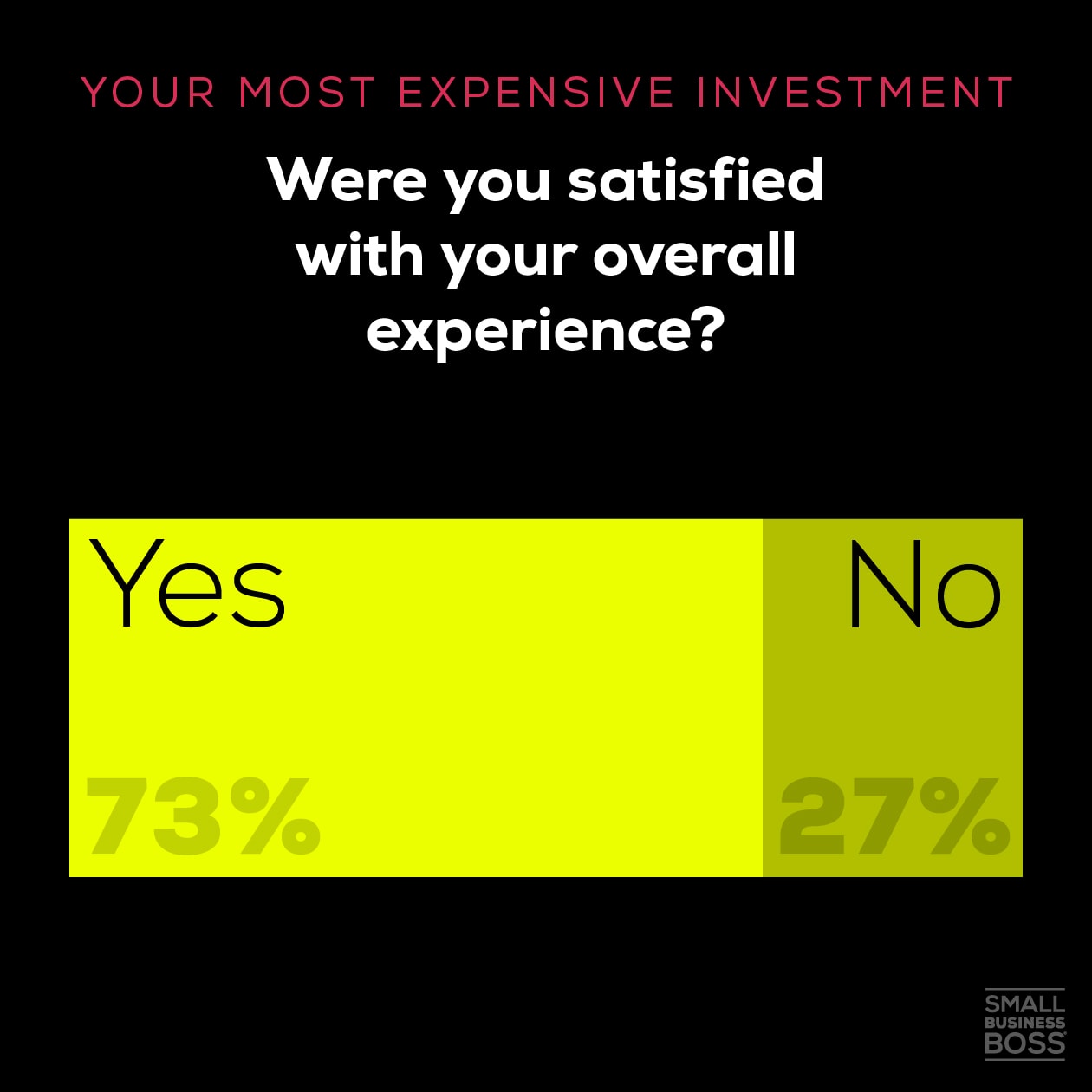

This explains one of the more surprising findings of this survey, which was that way more people were satisfied with their purchase than not. 73% of respondents were satisfied with their purchase, which I believe we can attribute to two key things: purchases were planned for and trust was a key element of their decision to purchase.

In analyzing these responses, there were several themes that carefully aligned with why people were satisfied including making connections and the quality and design of the program.

For the group that were satisfied with their purchases, here’s what they had to share:

"There's a really personal approach. No sleazy sales tactics ‐ and no teaching of sleazy sales tactics or similar either. And it's in a small group, so everyone is really getting personal."

- Solveig Petch, Brand Strategist and Identity Designer, Petchy

“The mastermind included an in-person retreat, and I found that retreat experience to be excellent. I was also able to connect with several other business owners and learn with and from them - and I’m still connected with them today. The relationships I made were the best part of the investment.”

- Lee Chaix McDonough, Founder, Coach with Clarity

In the other camp, these individuals shared a variety of reasons for being unsatisfied, many of which came back to the overall quality and experience.

“The program wasn't nearly as high touch as it promised. You had a coach assigned to you, but only had access to them via email. They had plenty of checklists for implementing different things, and mostly the coach would assign you different checklists. When I joined, I filled a questionnaire to fill them in on my business but I never quite got the feeling they got what I wanted, needed, or even did as a service provider.”

- Fabiana Nilsson, Business Coach

A lack of support and/or presence on the part of the leader was a persistent theme. This was named as a reason for being unsatisfied many times, with a range of concerns from “leaders were minimally involved” to the “success coaches just weren’t that good”.

Finally, when I asked how they’d describe their experiences, answers ranged from amazing to delightful to disillusioning to downright disappointing. This highlights how the right experience can be motivating, while the wrong one can leave you feeling frustrated and resentful.

What the Best Business Investments Have in Common

The best business investments were: group programs (29.3%), masterminds (26.8%), courses (24.4%) and and others (36.6%), which were mainly coaching related. What stood out to me is how coaching was the clear winner, which makes sense as in a one-to-one situation you receive personalized support and feedback.

The best investments ranged from under $249 to over $10k. Interestingly, nearly 25% of the best investments were under $500, which shows how an investment being a winner isn’t always because you paid a premium for it.

So what made these investments a win? It came down to two factors: getting the support needed either 1:1 or through a group, and having quality content. Those two things lead to tangible results for people, and a whole lot of clarity.

"Mindset and self-leadership were really essential for me the last couple of years. I couldn’t imagine getting through 2020 without that support system."

- Racheal Cook, Rachel Cook MBA & The CEO Collective

“Connecting with other people who are at my level so we can all grow together, facing the same challenges. and then supporting each other as we overcame whatever was holding us back.”

-Matt Hall, Content Strategist & Developer, Common People Web Design

Notice what people didn’t say? They weren’t just talking about making piles of money as a result of their investment, which is worth noting as that’s the most prevalent marketing and sales message in the market.

To dig a little deeper, I asked how the investment impacted their business overall, and multiple people shared how the confidence and clarity they got led to increased prices, new products, streamlined offerings and more.

“The relationship I developed with this coach has been one of the most powerful investments in my confidence and ability to run my business. Today they are still a trusted confidant and mentor.”

- Natalie Taylor, Sales Copywriter, The Missing Ink

What We Can Learn from the Worst Business Investments?

Next up, I asked about their worst business investment, and this shed a lot of light on problems across the online business industry.

These investments were a mix of group programs (31%), masterminds (16.7%), courses (40.5%) and other (21.4%), which includes coaching and memberships.

Again, the amount invested ranged from anything under $249 to well over $10k.

When asked why they made this investment, the answers were a marked shift from we just saw in the most expensive category.

While there were reasons like community and connections cited, the motivations here were definitely related to fear of missing out (FOMO), stories about making massive amounts of money and a general feeling that this investment would be the one that would change everything.

"I invested 3k when I had 1k on my credit card and honestly I felt horrendous. Sick. Stuck. Spiralling. Regret for spending. Anger at myself. I made it out of fear, and because the sales page and testimonials made me think I could make it all back in six weeks."

-Melanie Knights, Owner, Melanieknights.com and Host of the Entrepreneurial Outlaws Podcast

Yet, that was not what they ended up with. The answers to the “how do you feel about this investment” didn’t hold anything back with people sharing everything from being gutted to sick to infuriated to experiencing full-on rage. Plus, there was a distinct feeling of people having been screwed over using words like bamboozled and cheated.

Why were these investments so disappointing? When I asked what made for this being their least successful investment, survey participants shared a range of issues and challenges including:

- No results or ROI

- Flaky or no-show leaders

- Feeling like a number

- Lack of expertise

- Poor program design and delivery

"It was just too much information and not enough focus. The community aspect of it was overwhelming, too big to make real and deep connections."

- Solveig Petch, Brand Strategist and Identity Designer, Petchy

“There was a ton of information, but not a clear path through it. There were recordings in a bunch of different files, and each recording was one to two hours long and kind of rambling. There was some good information in there, but the time commitment was large and I couldn't figure out how to prioritize what to listen to.”

-Ellie Bender, Ellie Bender Coaching

"It was a group program with hundreds of other people ,so there was no individual attention. I got one idea for my content and that's it. The Facebook Group was very active and engaged, but it was overwhelming to me at that stage of my business."

-Caron Matthews, Money Coach, Pocketbrook

There were also a number of individuals who shared how they felt manipulated or duped:

“I felt coerced into buying the course on a 12-month payment plan because the salesperson who I had a call with made me feel as if I wasn’t allowed to get off the call to think about it. Which is a real shame because I was actually super excited to join, but that really tainted my outlook on the company, and therefore the course.”

- Mai-kee Tsang, Podcast Guesting Strategist & Founder of the Sustainable Visibility Movement, Mai-kee Tsang

“This was a straight-up SCAM. She’s a super well-known business owner now. And honestly, the most useful thing I got out of this program was the free t-shirt she sent.”

- Eman Zabi, Founder, Terrain

Why Are We Still Being Manipulated?

Survey results illustrated how not all investments are created equal, and how as consumers, we need to do a more rigorous job of vetting when and where we invest.

This is particularly important as I also wanted to dig into how as consumers we found ourselves being manipulated, and making purchases we simply couldn’t afford.

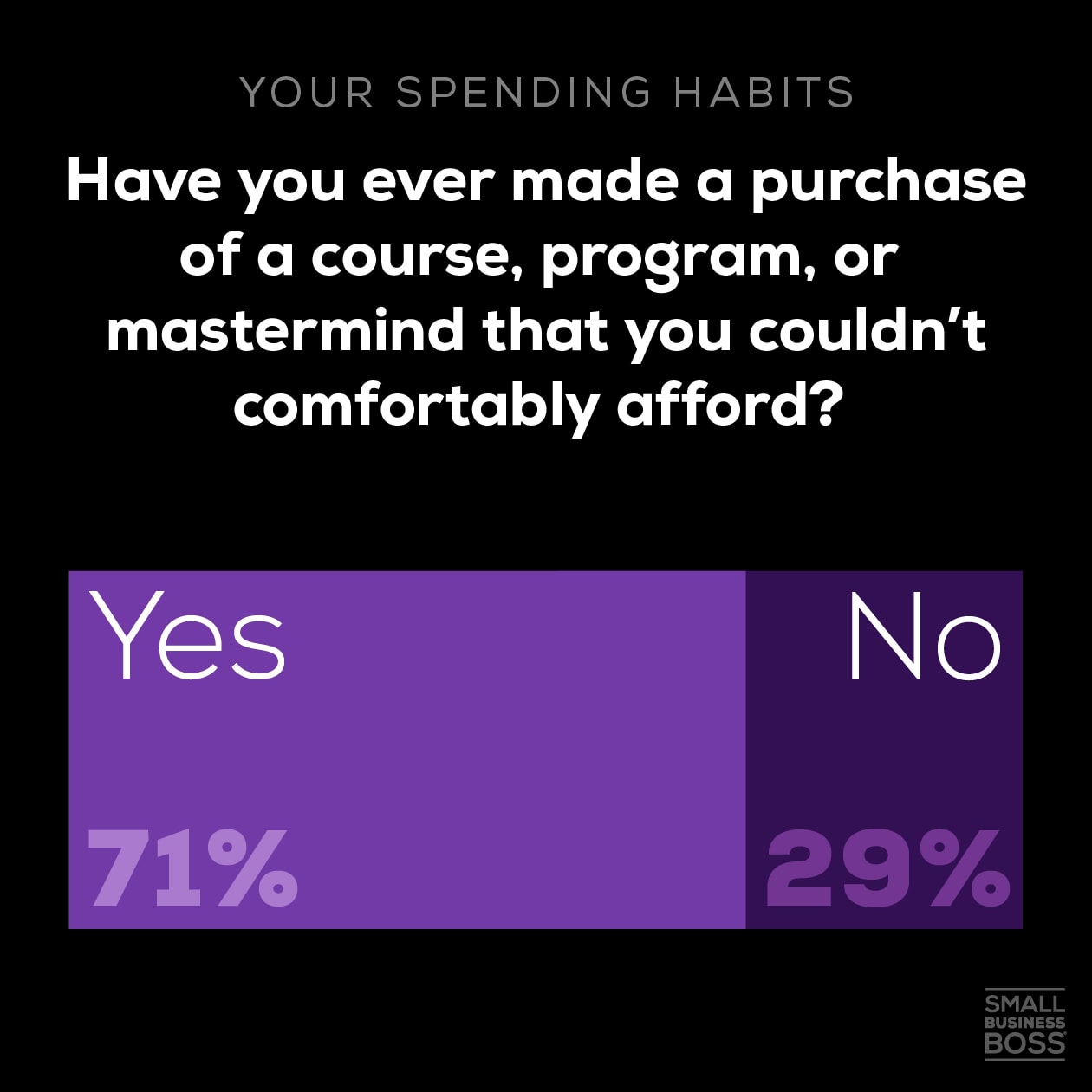

First I asked if they’d made a purchase they couldn’t comfortably afford, and nearly 71% of people responded yes.

Let that sink in. Most of us are making investments that are uncomfortable with.

Why? I believe that it can be chalked up to how we’re taught to believe that investing in our business is normal, and reaching past our budget is a condition of success.

Remember the stories I shared at the start of this essay? Those are all actual stories with very few details changed.

And these are not the exception. Every day I see these stories and it normalizes the narrative around how we need to stretch ourselves and our budgets so that we show that we’re truly willing to do what it takes to reach our goals.

It’s time for us to shift to a place where we normalize people budgeting and waiting to make an investment. Especially as these survey results show that the results promised often fail to materialize.

Another issue that needs to be addressed is the use of high pressure sales tactics and the heavy use of FOMO. When I asked about if anyone had made an investment due to these tactics, 68.3% said they’d made an investment as a result.

The stories shared with me about these high pressure situations and how they felt in the moment were telling:

“I felt sick on a sales call and the clear feeling that I was in someone’s debt already.”

-Leah Steele, Trainer, Searching for Serenity

“Kind of desperate. Grasping at straws. Not in touch with what I really needed, but feeling like this may be the missing piece.”

-Ellie Bender, Ellie Bender Coaching

"I felt incredibly unsure, but I made the purchase anyway because the sales rep (who was a coach) convinced me that I was getting in my own way by letting fear make my decision for me. I want to throw up just thinking about this because it was so disgustingly manipulative."

-Caron Matthews, Money Coach, Pocketbrook

5 Key Takeaways to Apply to Your Online Business

While writing this essay I spent a lot of time analyzing and working with this data to figure out what we could take away from it. Data is great, but it doesn’t matter if we can’t learn from it. Here are the key takeaways:

#1. More Expensive Doesn’t Mean Better

In looking at people’s best investments, many people were able to get exactly what they needed without spending $5,000, $10,000 or more. In a world where $25k+ masterminds are viewed as a must-have to get ahead, this finding was particularly refreshing.

We need to stop overvaluing these offers because they cost more. If you’re tempted by a high-ticket offer, stop and consider if you want it because it says something about you or you believe it has more value, or if that’s really and truly what you need.

For a long time I wondered if I’d ever be able to make it without investing in a big money mastermind. While I do know many people who’ve had great results from their premium mastermind experiences, I think I knew deep down this wasn’t the right choice for me.

The fact I’m sitting here today and my business is doing better than ever is proof positive that you don’t need to spend your way into the circle of cool kids.

#2. We Need to Get Clear on What We Need

To get the most out of every single investment we make, we need to get clear first on what we really need. From all of the data collected it was evident that different styles of programs work better for different people, but one thing can make or break the experience, which is having support.

That can be the right type of group support, or 1:1, but we need to vet our investments to ensure we have a path to success, a place to ask questions and not just be another credit card number they charge on a monthly basis.

Instead of jumping right into investments and hoping it will work out, we need to figure out why we feel like we need help, and plan accordingly.

#3. Beware Sketchy and Scammy Sales Strategies

One of the big reasons I started this project in the first place was to gain more insight into what was really happening with sales in our industry.

What I discovered is that much of the status quo of sales in online business is still driven by fear and high pressure tactics. People are constantly being preyed upon every step of the way so that celebrity entrepreneurs and their wannabe can grow their bank accounts.

It’s worth noting that there’s lots of good in this industry. Many people had positive experiences to share, and that gives me hope that things are changing.

As business owners, we need to consider how we can move away from these fear-based tactics and take a more trust-based approach to sales. That shift is particularly important as trust was a top reason that people made their most expensive investments.

#4. Inclusion Matters

Throughout the survey the theme of inclusion came up over and over. Many people expressed frustration and disappointment at how people were dealing with anti-racism and inclusion in their businesses.

In multiple instances respondents shared how this was a deal breaker resulting in them exiting programs, and seeking out people who reflect their values.

As a business owner, you need to get this handled, especially if you say publicly this is important to you. It’s not enough to reshare anti-racism content on Instagram. You need to ensure your paid offers are creating a space that’s anti-racist and inclusive. As part of this, your paid communities need to be moderated effectively, and a clear code of conduct needs to be in place.

#5. We Need to Become Better Consumers

A large number of the people participating in this survey feel like they’ve been scammed or burned by the investments they made in their business.

I want each of you to know, you’re not alone. This experience is more common than most people realize, but it’s simply not talked about due to shame or fear of pissing off a big name in the industry.

A huge reason we can be manipulated is that we’re hopeful and we want to believe so badly that this will be the thing that works. I know this is something I’ve seen with myself, and many of my clients –– we convince ourselves that this investment will be the ONE.

“I was operating from a place of fear and scarcity, and wanted to believe that this program would be the magic key that unlocked the secret of a successful business. I went against my gut and did it anyway. Lesson learned.”

- Lee Chaix McDonough, Founder, Coach with Clarity

“I felt anxious, desperate. I was naive. I thought THIS one thing will be the ticket. Now I know better.”

- Patricia Grenseman, Postpartum Doula, PPDoulaPatricia

"I felt hopeful in the moment, that this would be the secret sauce I needed. I had almost immediate regret. I made it because I was scared of failing because I wanted support and a sense of community. I feel sick writing about this now."

- Laura, Laura F Creates

To combat this, we need to train ourselves to be better consumers. That starts by not looking at anyone in this industry as having the secret sauce to our success.

Success comes from many small things that accumulate over time. There wasn’t a single response about any of the investments which anyone named as the one thing that magically made their business into a wild success.

Foster Self-Trust and Take Back Your Agency

Right now, the online business industry has work to do, and the reality is that these marketing messages and sales strategies aren’t going to go away overnight.

To protect ourselves as consumers, we need to trust ourselves more and stop giving away our power to people who don’t necessarily care about us.

Fostering self-trust and taking back our agency in making these decisions is crucial. When we do that, we’re able to make fully informed decisions, engage our critical thinking, and most of all ensure we trust the people we’re planning on paying before we buy.

To help you ask better questions and engage in critical thinking about your business investments, check out the Trust Audit Checklist below to help you get started.